Underwriting Workbench – Solution Framework

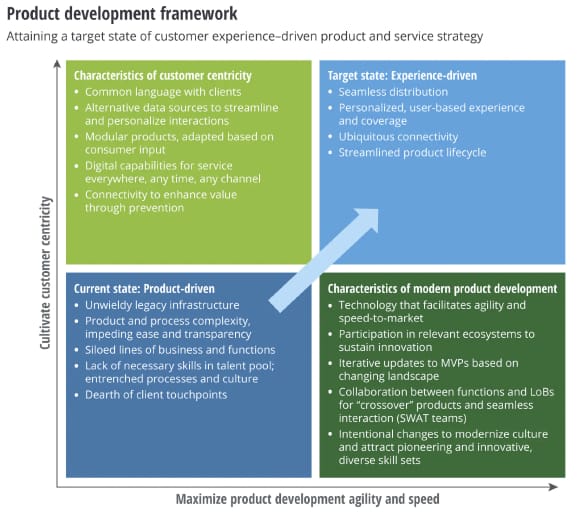

Our UW workbench Framework Solution was created working backwards from customer feedback, making sure that everything we build met the issues raised by Underwriters, and we keep improving with the same philosophy (See Product development framework image).

Our UW workbench Framework Solution was created working backwards from customer feedback, making sure that everything we build met the issues raised by Underwriters, and we keep improving with the same philosophy (See Product development framework image).

WeMakeIt easy to tackle these issues:

Slow time-to-market

Business and IT chasms

Off-the-Shelf solutions not flexible enough

Expensive choice between not-good-enough Build

Dependence on inflexible and disconnected legacy systems makes it extremely time-consuming and expensive for carriers to launch new products and update existing ones

Inflexible off-the-shelf solutions: Off-the-shelf solutions leave customers, brokers, and underwriters with a disconnected experience because they are not easily customized

Misalignment between business & technology: Lack of visibility from legacy technology development patterns means the business teams cannot play an intimate part in the development process, often leading to solutions that don’t meet the exact business or customer needs

Expensive to build on your own and to have as a SaaS: usually you are faced with the choice of “Build or Buy”, but what if there was another option? What if you could buy a SaaS product AND build it to your needs?

Our UW Solution Framework has 80% of everything you would like to have for your Underwriters. The 20% you believe that could be added, we can change and adapt for you in record time because we are using state-of-the-art low-code technology by using the Siemens platform Mendix Low-Code.

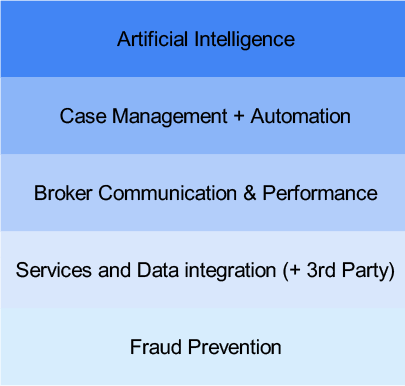

Functionalities you will find in our UW Workbench:

- Artificial Intelligence: quickly integrate your models into the application

- Broker Communication: Negotiate with brokers more effectively for better pricing and terms

- Data Integration (+ 3rd Party): Incorporate new data sources that enable more informed risk selection Quickly react to changes in risk

demographics (e.g., age, urban versus rural environments, virtual/gig economy workers, etc.) - Leverage operational data to identify bottlenecks and guide continuous process improvements Eliminate unnecessary data entry to streamline

the customer journey and increase underwriting capacity.

Bring Innovation, Artificial Intelligence and even startups to your UW

At WeMakeIT, we believe technology should boast Underwriters, not hinder them.