Cognitive Claims – Solution Framework

Churn is the biggest plague in Insurance affecting the Combined Ratio as statistics show* that on average 20% of customers will churn every year leaving the acquisition cost hefty on the expenses side and even more so when they already have a claim. Statistics also show that the main factor is high customer effort as customers canceled their contracts because companies wasted their time in a Claim or managed it poorly.

This perceived service sharply contrasts with internal statistics of insurance companies that reveal that more than 95% of claims are handled within established KPIs.

There is clearly a disconnect between perceived service from the point of view of customers accustomed to “Amazon-like” customer centricity and Insurance Companies’ processes and KPIs for Claims Management.

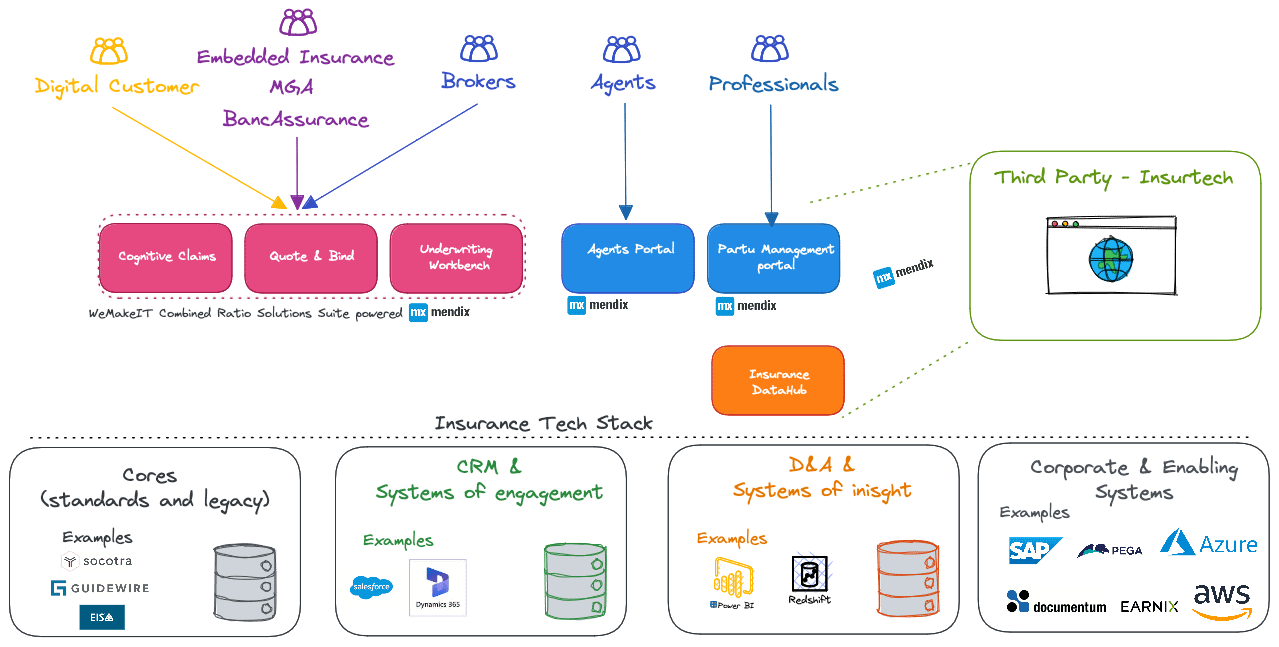

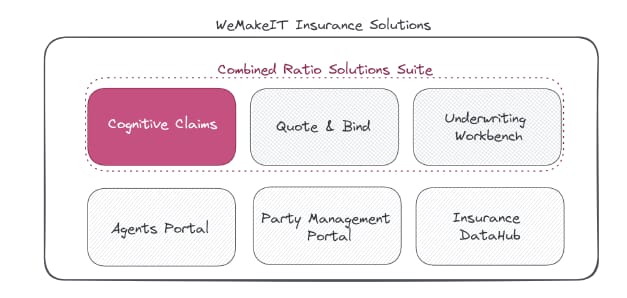

Our Cognitive Claims “Solution-Framework” opens the realm to the ecosystem of Cognitive services and Artificial Intelligence to improve customer satisfaction, improve fraud detection and reduce overall costs of processing claims which helps the Combined Ratio both on the reducing customer churn, but also through savings on the side of Claim Management costs.

Lets also not forget fallout from word of mouth as the majority of customers of customers admitted sharing their disappointment about an insurance company’s level of service with others which in turn creates an unmeasurable (yet obvious impact) both on new business and on existing customer portfolio.

*statistics provided by https://techsee.me/resources/reports/2019-insurance-churn-survey/

Bring Innovation, Fraud Analysis, automation, Artificial Intelligence and even startups to your claims process and improve your combined ratio and customer experience.